Advantages and disadvantages out of Financing Equipment To greatly help Construct your Team

There is no one method to financing a business, specially when youre merely starting. Based your product, your community, along with your personal creditworthiness, you may have to tailor along with her an economic quilt that helps your organization develop. It’s no effortless accomplishment, however, drawing into financial support designed for extremely specific spends, eg products financing, will help section the fresh puzzle together from inside the a manageable means.

When you really need gadgets to keep your business running or perhaps to improve current devices to boost output, asset-supported financial support will probably be worth offered. Gadgets funds are often better to safer than just old-fashioned title money and certainly will protect funds move by allowing on slow payment from a secured item over the years. Find out the advantages and disadvantages out-of equipment financing as well as the means in which it may be good for organizations any kind of time stage.

Secret Takeaways

- Gadgets finance enable it to be a bit of equipments so you can act as the newest primary guarantee, which will make the approval process slightly smoother, specifically for small enterprises.

- Gadgets fund and rental was one another options for gizmos funding. Which have financing, businesses enjoy the benefits of having the resource throughout the title, however, monthly installments are large; which have a rental, the business simply rents the machine.

- Products finance are supplied by many brand of organizations, including the SBA via the 504 mortgage system.

- Just like any resource, it is very important research the best fit for your organization. Costs, terms, eligibility, and you may money limits most of the vary by the bank.

Just how Products Investment Functions

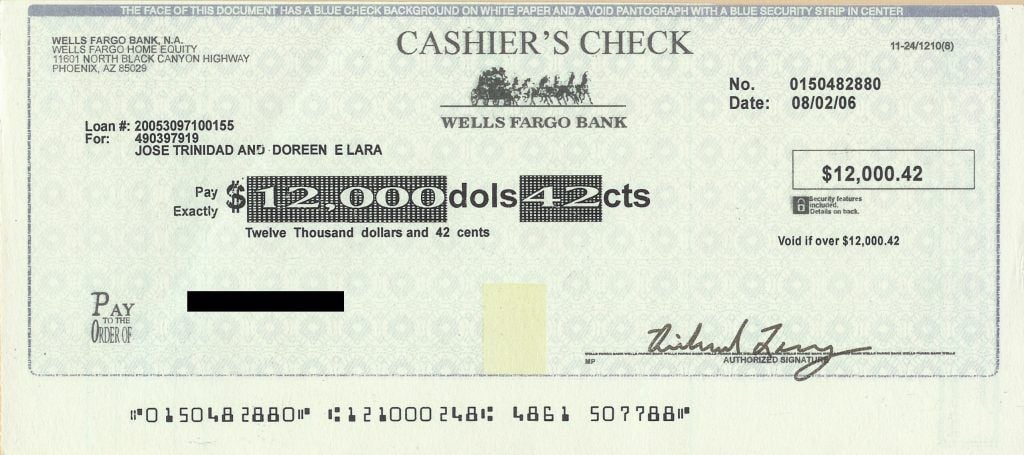

Gizmos loans they can be handy whenever you are finding a certain variety of financing to suit your needs. Using this particular loan, the company have a tendency to pays an adjustable down-payment with monthly repayments on the the machine financing. In cases like this, the newest devices have a tendency to serves as a portion of the guarantee for the financing, even though some extra equity may be required with regards to the borrowing worthiness of your business as well as residents. And in case there’s no default, at the end of the phrase, the company possess the brand new piece of equipment.

Products money appear from some lenders, borrowing unions, and enormous financial institutions, through the Home business Administration (SBA), and frequently through the gadgets brand name actually. Rates, terms, and you will certificates to own equipment fund are different ranging from lenders, regardless if most products mortgage terms and conditions average around three to help you seven decades. Particular might require private guarantees, pledged property, otherwise down costs depending on the loan-to-worth (LTV) ratio. The new LTV ratio ‘s the lent count separated from the really worth of one’s resource, that will be normally place by the bank.

Old-fashioned loan providers get set more strict LTV percentages depending on the health and you can age of your online business, so that your business could well be required to shell out a bigger advance payment, sometimes more than 20%. Because of changeable LTV ratios and you will rates of interest, providing more substantial down payment you may raise your odds getting devices mortgage approval.

Particular lenders engaging in the brand new SBA 504 mortgage software may installment loan no credit check Hamilton be prone to money at the very least ninety% of one’s price of the machine, which means a smaller sized off costs to possess companies that meet with the 504 standards.

A big, built-into the piece of guarantee can frequently indicate a simpler road to approval in the place of traditional business loans, thus gizmos funding is actually a famous route to own businesses of all designs trying to inform its process without having to sacrifice cash flow.

Devices Financing against. Gizmos Local rental

Products financial support isn’t the best possible way to add brand new machinery towards the providers. If you are searching to get rid of a number of the way more cumbersome financing official certification, equipment leasing may be valued at offered. With local rental, a business fundamentally rents a piece of gizmos throughout the financial or, sometimes, directly from the manufacturer to have a selected amount of time.

Products local rental essentially does not require a downpayment otherwise one even more collateral requirements beyond your device. Monthly rent money are often less than an equipment financing, and since the firm does not very own the bit of devices, the onus to own repairs, upgrades, and, in some instances, normal repairs lies towards the lender. It is a large benefit to possess small businesses just who can not manage to improve and you may exchange trick possessions one discover a lot away from damage.

Particular products leases, instance a funds rent, can offer the company the opportunity to purchase the equipment from the the end of brand new lease to have fair ent local rental is commercially a rental, yet not, the company may not enjoy the decline benefits of investment possession afforded from the Section 179, enabling 100% off purchase price off possessions are subtracted.

In comparison to a capital lease, a working lease allows the equipment are returned on avoid of the term. This is certainly very theraputic for gadgets, application, or tech that highest return otherwise means frequent standing.